It’s the end of the month, and your small business is booming. Wouldn’t it be great to have a financial statement that shows you what you did well, how you could improve, and potential ways to manage money more effectively?

A statement of cash flows can break down your inflows and outflows every month or year to help you better understand your business's spending habits. Continue reading to learn how to calculate cash flow in five simple steps, and download a handy cash flow template.

There are three core parts to a cash flow statement. To create a cash flow statement, review each cash transaction on record, and assign the dollar amount to one of three categories.

Statement of cash flows operating activities refers to day-to-day business management activities. The majority of your cash will be from operating cash flows. Buying materials, managing payroll, and collecting customer payments are all examples.

Investing activities in a cash flow statement refer to the inflow and outflow of investment capital for your small business. If your business purchases or sells an asset for cash, you'll post the impact here.

Financing activities in a cash flow statement refer to transactions that create funding for your small business. When a company raises money from investors, borrows funds, or pays down a loan, those cash transactions are classified as financing activities.

Calculating cash flow might be easier than you think. You can begin preparing a statement of cash flow in five simple steps:

1. Find the starting balance: You’ll need your starting balance from your latest income statement if you are using the indirect method to calculate cash flow.

2. Calculate operating activities: Subtract all your operating expenses from any earnings gained through business operations.

3. Calculate investing activities: Report any earnings or losses from company assets here. This includes land, vehicles, and equipment.

4. Calculate financing activities: Share any funding or financing you receive here. This includes debt payments, equity, and fundraising.

5. Share the ending balance: Combine the totals from your operating activities, investing activities, and financing activities calculations to achieve your end balance for this reporting period.

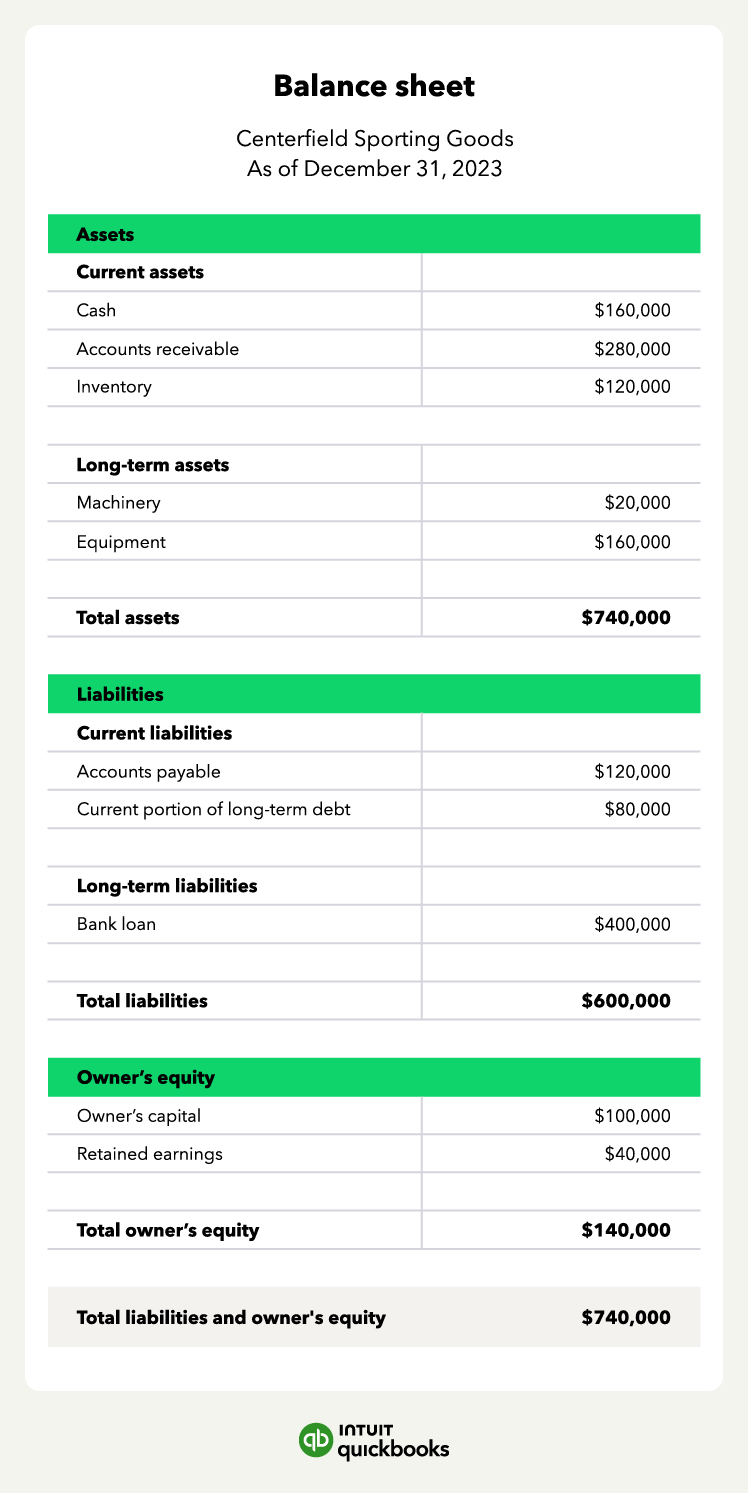

A cash flow statement lists the cash inflows and outflows of cash for a period of time, and the ending cash balance is the same dollar amount reported on the balance sheet .

You can calculate operating cash flow using the direct or indirect method:

Here are the main differences between the two methods:

After you calculate your operating activities, investing activities, and financing activities, use this template to calculate your statement of cash flows for this reporting period.

If possible, keep a copy of your income statement and balance sheet nearby to plug in your available cash across all of your financial statements and are ready to prep for the next reporting period.

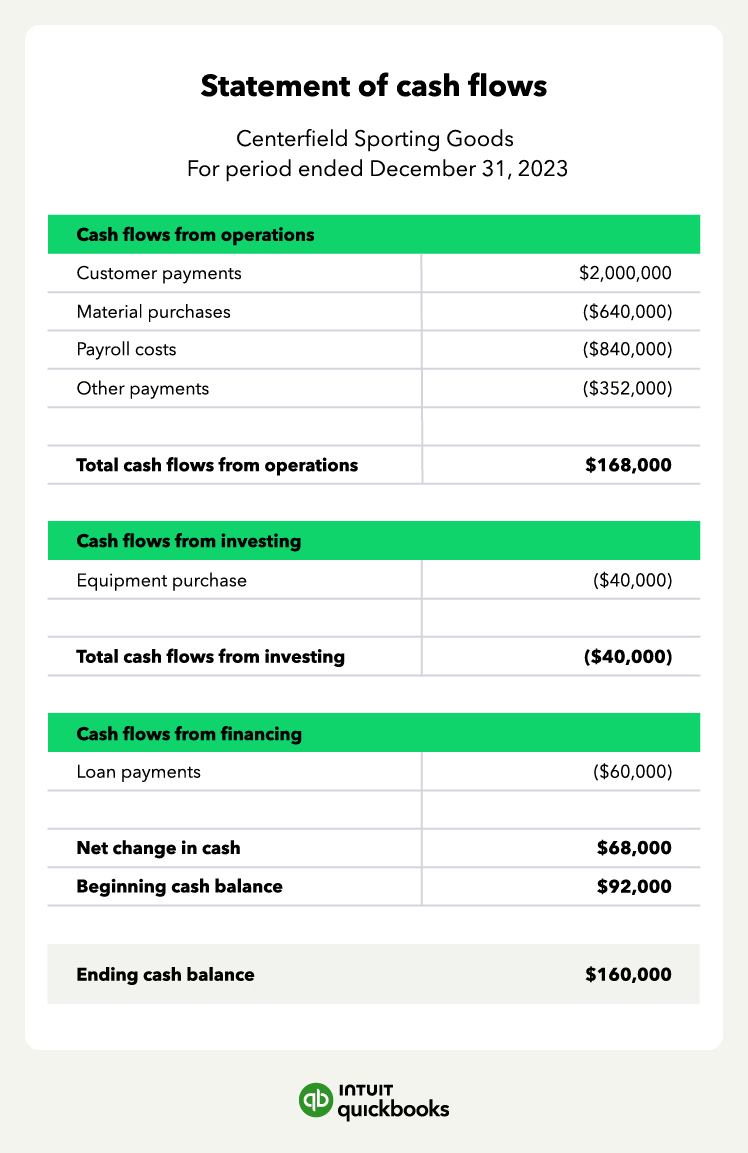

Here's an example of how a small-business owner uses the direct method to produce a cash flow statement:

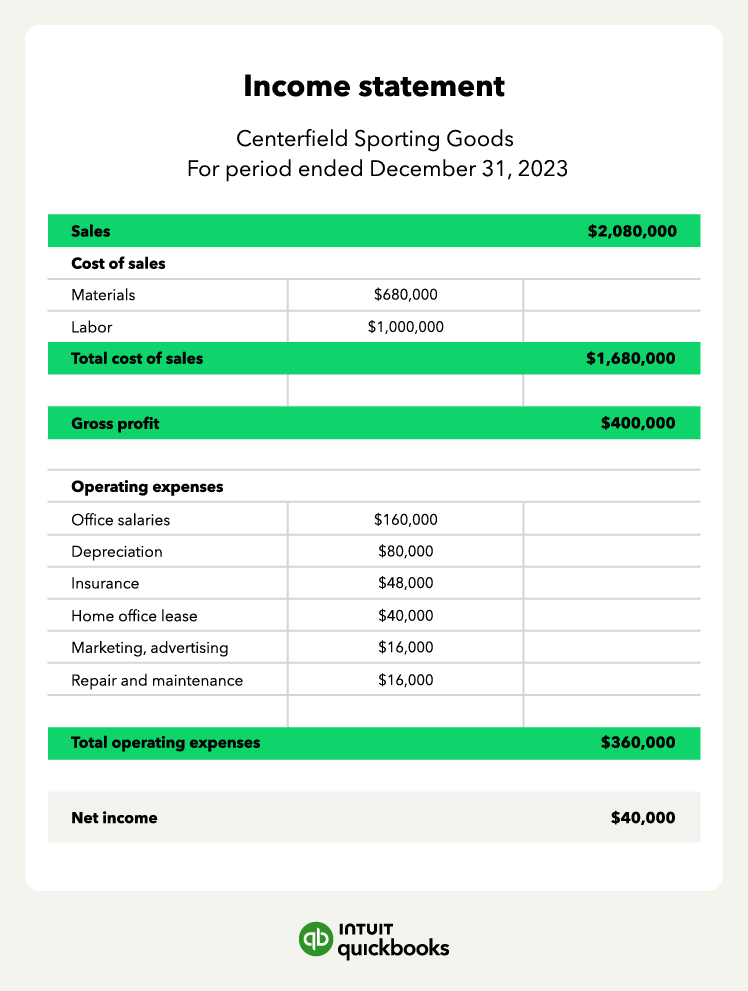

Julie owns Centerfield Sporting Goods—a firm that manufactures sporting goods products and sells them to retailers. Here's Centerfield’s income statement and balance sheet as of 12/31/23:

The income statement reports $40,000 in net income for the year, and net income increases retained earnings in the equity section of the balance sheet. Here's her statement of cash flows:

With the ending cash balance, Julie will be able to make informed decisions about how to use her cash in the next reporting period.

Organizing your financial statements is even more important as your small business begins to scale into a midsize company.

Utilizing reliable accounting software ensures that your finances are easy to reach and update so that you can maintain your focus on what matters most.

If you haven’t already, consider using our free template to craft a new business plan that addresses your needs and goals as a growing business.

The direct method requires a reconciliation document to supplement the cash flow statement, while the indirect method requires a net income starting balance to begin.

Why is a statement of cash flows important for business accounting?A cash flow statement is one of the three major financial statements that showcases the health of a business.

What is the difference between a cash flow statement vs. income statement vs. balance sheet?A balance sheet is a snapshot of a company’s financial position as of a specific date. An income statement reports revenue, expenses, and net income for a specific period of time. The statement of cash flows helps a business owner understand the differences between net income and the activity in the cash account.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.