Are you a new member on your HOA Board, working on figuring out the in’s and out’s of your Board duties? Or are you a seasoned HOA leadership veteran who would like to learn more about a new reporting system your HOA has implemented? Most importantly, are you looking to become a pro at reading HOA financial statements? Then you have come to the right place.

It may seem like too obvious a notion, but with the vast variety of HOA financial statements available from different softwares and bookkeeping companies nowadays it is easy to lose track of which information is important for your HOA Board’s purposes. This could lead to losing focus and moving even farther away from your goals than your HOA team was to begin with.

Community Financials, the Nation’s leading company in helping your HOA self-manage while providing accounting and bookkeeping, has compiled a list of resources that will help you determine the four most essential statements to determine the financial health of your HOA or Condo Association.

In short, these four statements are as follows:

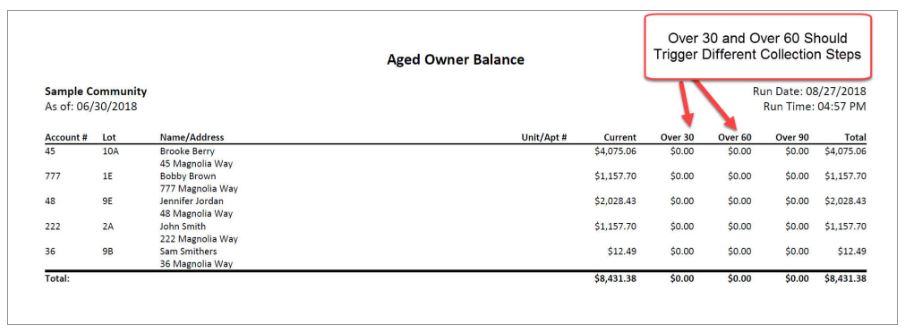

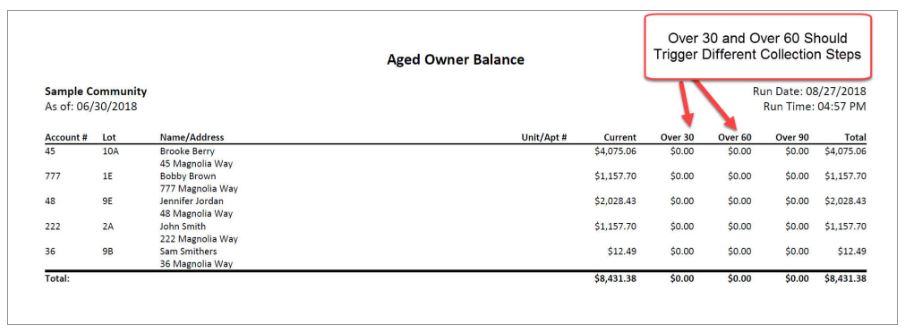

This report is going to be your biggest money-saver – guaranteed! Without extra information cluttering it, this report shows who is behind on their assessments and how long they have been owing.

It needs to be set up to show the following key metrics:

Based on the data you have set up to show when the report is run, there are many ways to interpret the information you get. The main goals of the HOA Aged Delinquency Financial Statement is to determine which homeowners owe money to the HOA or Condo Association, how much they owe and how overdue their payments are.

What you choose to do with this information is up to the Board’s best practices, but sending a series of written reminders followed up by a late fee and, if it comes to it, referring the case to a collections agency, are common next steps. If you don’t start the collections process soon enough you risk losing as much money as if there was internal embezzlement.

Each Board has their own Collections Policy. Have you discussed yours with your HOA/Condo Association Board?

You can also watch the video with Russell Munz, the CEO of Community Financials explaining this HOA financial statement in detail below:

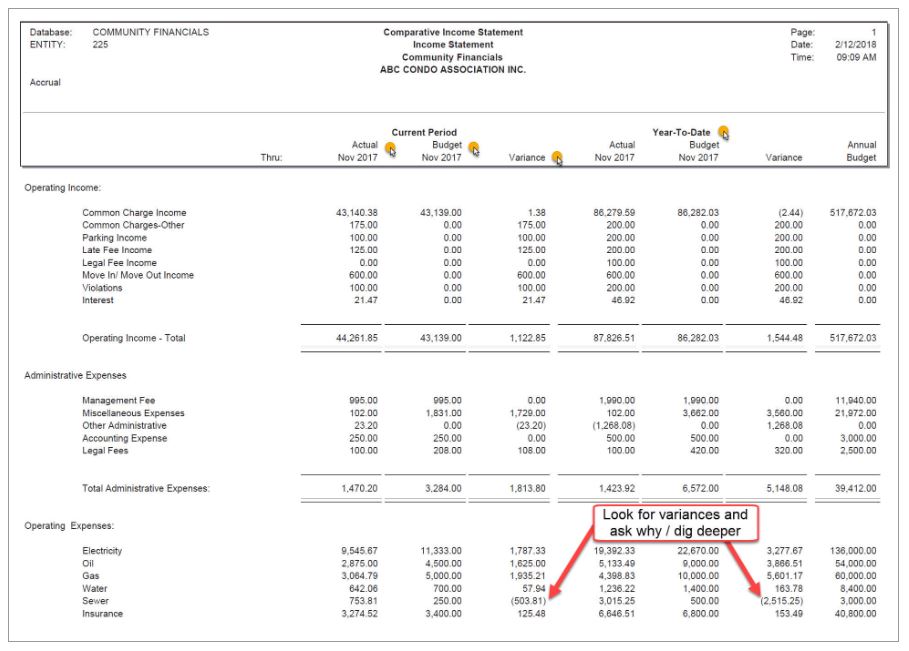

Another handy tool is this report that shows how the HOA or Condo Association is doing compared to its budget. Budgeting is essential, and as it is something that is presented annually in advance to HOA members the Budget should be adhered to as closely as possible.

Catching discrepancies early can help you make up for any shortfalls and ensure that enough money is available for the required vendor payments and meet the community’s budgeted needs.

It needs to be set up to show the following key metrics:

The goal of this report is to show the HOA Board where your budget is in relation to current expenses and income. This information is important to keep in mind when planning your next year’s budget and can help pinpoint discrepancies before they become an issue that is more difficult to fix.

On first glance, the main columns to pay attention to are the ones which show if the actual expenses for each maintenance category are similar to the budgeted amount. If not, you can then either adjust the budget going forward or see about limiting your spending on certain services.

While discrepancies in the monthly/current period line items are not critical, the annual line items should be paid special attention to once you are nearing the end of the fiscal year. Does your HOA have a plan for keeping spending on track?

You can also watch the video with Russell Munz, the CEO of Community Financials explaining this HOA financial statement in detail below:

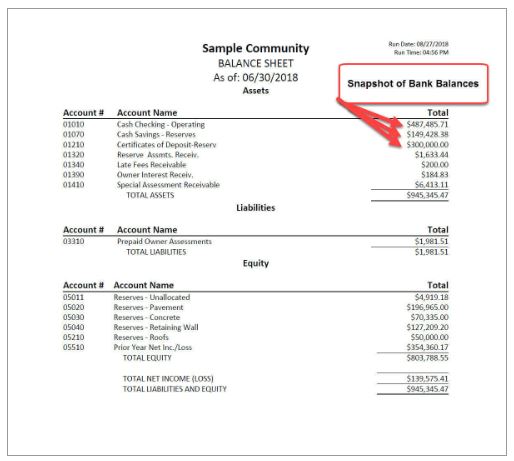

Unlike the previous two reports, this one focuses on both the positive and negative bank balances of your HOA or Condo Association.

Through the assets (money in the checking accounts), liabilities (amounts owed, AP) and equity (capital reserve funds) you will be able to see a clear picture of the bank account status.

The Balance Sheet shows the current state of your HOA/Condo Association’s bank accounts. This information is important for making sure there is enough money put aside for taking care of bills and other HOA expenses.

You can also watch the video with Russell Munz, the CEO of Community Financials explaining this HOA financial statement in detail below:

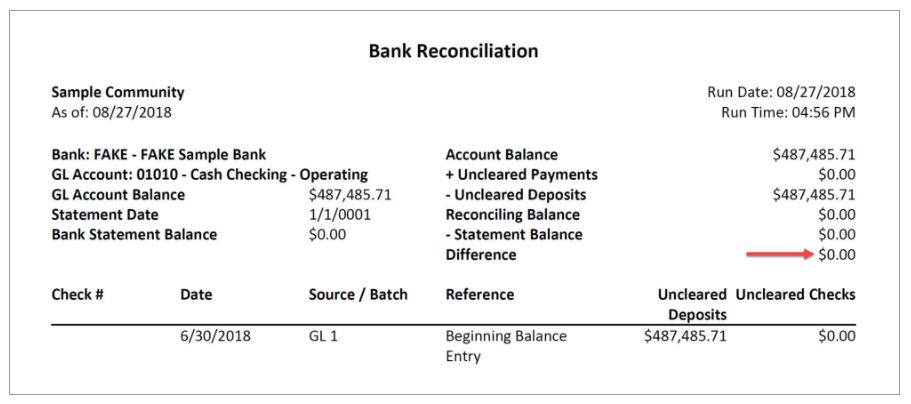

Unlike the Balance Sheet, this report is as straightforward as they come – there either is a discrepancy in the Association’s books and bank account or not. Before running this report one should also take into account uncleared payments and deposits, because the timing affects the results significantly.

If there is a difference between the two, there may be embezzlement happening in your HOA, or some other issue that would be wise to catch sooner rather than later.

It needs to be set up to show the following key metrics:

The main purpose of this HOA financial statement is preventing fraud – and it is very easy to tell what is happening in the report at a quick glance. There are lines that show if there are checks or payments that have not cleared as well as the current account balance – but the #1 most important line to look at is the “Difference” line.

It should always be 0, and if it is not that means there is a discrepancy between your HOA/Condo Association’s bookkeeping and the banking – which should be addressed as quickly as possible.

You can also watch the video with Russell Munz, the CEO of Community Financials explaining this HOA financial statement in detail below:

If you are yet to create the reports listed above, we are delighted to share an easy 5-step guide on setting up your financial reporting for an easy streamlined process, or if you are looking for more in-depth information you can view our webinar here.